Blog: Which Way To Market?

In this short article Stuart Michael explores the new consumer of China, and how the rest of the world should grasp the opportunity to fulfill their demands.

Exporting your Premium Brand to the fastest growing sub-economy in the world.

The Chinese economy is growing, we all know and understand that. One of the primary spin-offs of the growth in the private sector economy is that a new group of "nouveau riche" has been created and has been thriving for the past 10 years. Perhaps not all as "riche" as the Yuppies and Dinkies of our forefathers/mothers, but nonetheless wealthy by US standards, and wealthy by 1st world standards. I call them the New Consumer.

With average monthly minimum incomes now at over $1200 USD and average annual incomes hurtling towards $20,000 per year in the primary and second cities, the level of disposable income on affordable luxuries, and the predilection of the New Consumer to both demand and be able to afford luxury goods is only now being serviced- and even that is sporadically .

Anecdotally over 90million people within the 1.5Bn population of China, now earn in excess of the minima, and over 10m would be deemed to be High Net Worth consumers.

With the enhancement of communications the Chinese consumer is habitually observing the lifestyle drivers from the Fashion and Arts centers of the world and is demanding the quality of design, and the safety that global brand offers. The baby milk fiasco has taught some very hard lessons to the Chinese consumer.

So, why the article?. Its all about access. The China consumers entry to the consumables market has spawned a burgeoning personal import marketplace, where "your overseas family and friends" buy for you and bring home, or send home from their overseas homes. Its fragmented, and China border control and Customs seize as much as gets through and much of it is still counterfeit.

The alternative route to secure the products they demand, is for the consumer to identify a local trusted Chinese retailer who are already providing established and great quality local products and services to the new Consumer. However this is still an immature market with significant barriers to both direct and intermediated entry for foreign manufacturers and Brand producers.

Our New Consumers meet an interesting demography, because the concept of "old money" isn't as powerful as it is in the West our New Consumer is younger, she is a manager, executive or business owner. There is no obvious glass ceiling in the new China. She is stylish and wants to buy global fashion brands that are slowly becoming well represented in many Chinese Cities.

But she also wants to buy home products, accessories, linens, soft furnishings and cook shop, that make a statement to her friends, and identify her as a new proud Chinese consumer of local and International products.

A small number of Chinese domestic retailers are realizing the opportunity this creates, and are attempting to secure Global Brands and to understand Visual Merchandising, and to recognize that customer and brand loyalty will drive the O2O market (On-line to Offline) which brings loyal and aspirational customers to their stores via their on-line presence.

We have been working with China for 30 years - and have seen this evolution from Bicycles to BMW's from factory knock-offs to the real Louis Vuitton, from dangerous chemicals to branded eco-friendly cleaning products. At every level of the China consumer economy, the demand for good, better, best, is growing exponentially.

Here are my thoughts on how to understand and work with this burgeoning market.

- The route to market is a two way traffic, it requires time, investment, persistence and transparency between the parties

- We must show respect to our Chinese Customers and take the time to understand the Consumers legacy sensitivities to color, fragrance and style.

- We must learn the languages of our customers (its not just Mandarin!) and communicate in the same respectful way that we communicate with our clients in every other country.

- We must understand the concept of trade in China over the past 30 years has principally been to export, so importing can be clumsy and protracted

- The State is highly protective within the Import market. The Government of China strive to ensure quality and standards for everything. For the Western manufacturers, this can be frustrating and time consuming, but we must understand why.

- We must recognize that our successful local retailer doesn't understand the difference between FOB, C&F and DDP, and will be frightened of taking on a daunting import transaction, when there is a local product that will "suffice".

- Governments must not try and coerce the Chinese government or people with Tariffs and Trade Embargo's these are the blunt tools of a bygone imperial age deployed where weak leaders feel threatened because the global economic power matrix has changed irrevocably.

- The way to improve local manufacturing and reistate local jobs is to build up export. As an economy recovers the time lag to improve demand can be accomodated by championing Export and to embrace Free Trade.

- The magnet to attract good business is a level playing field, irrespective of the shape of the football!

- It appears I am not alone in considering this the greatest opportunity in the world today,

- Take a look at this:

Business Insider Article

Credit Suisse 2015 Wealth Report

Western brands have been targeting the super rich in China for a long time. That's not unreasonable, when you consider that China has 568 billionaires, compared to the United States' 535 - according to The Hurun Report. This gives China the largest billionaire population in the world.

However, Landor, a global brand consulting firm, thinks that the biggest opportunity for western companies in China is to "seduce the farmer," - the growing middle classes.

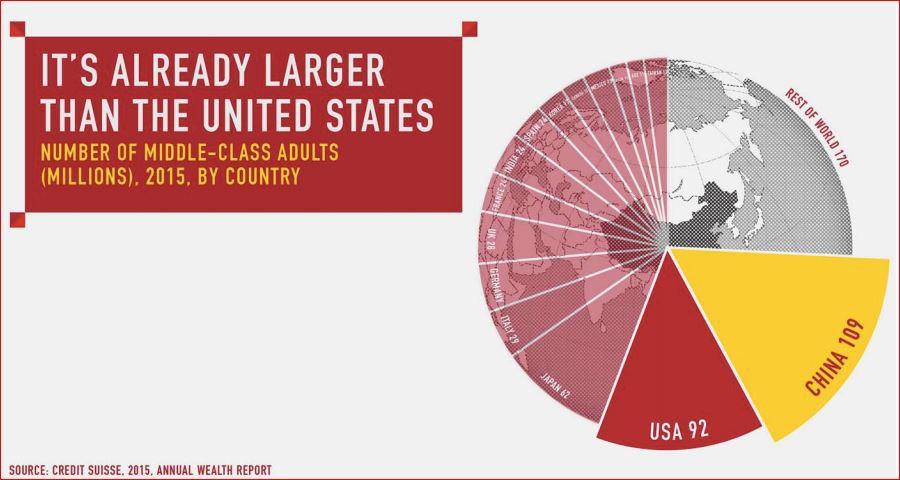

- China's middle class population is the biggest in the world.

- Data from the Credit Suisse 2015 wealth report shows that China's middle class population is bigger than Germany, the UK, France, and Spain's combined.

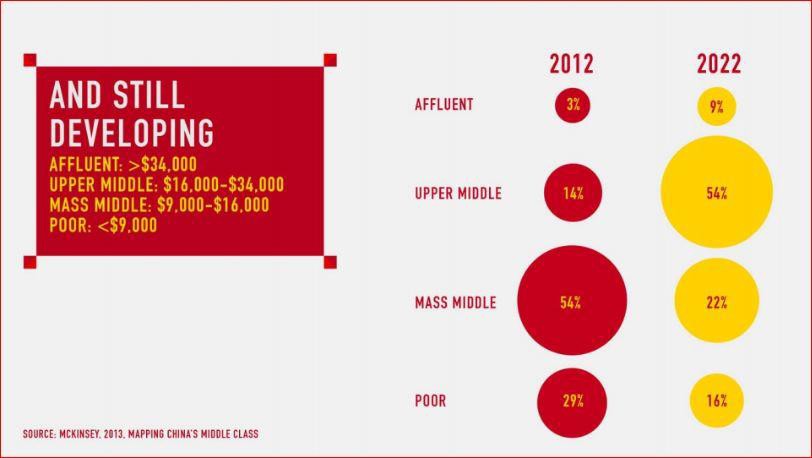

- China's middle class is growing and getting richer at a rapid rate.

- By 2022, 76% of China's population will be made up by those defined as the middle class, according to a 2013 McKinsey report. The majority will be in the upper middle class, earning at least $16,000 per year.

Immediate Trading Opportunity- Premium Brands

We are retained by a very large Chinese retailer, which has over 2500 large-footprint, premium stores, with around 500 in the leading shopping malls of China. Our brief is to identify and introduce suppliers of Global Brands and merchandise for consideration for their stores as demand for premium products from within the Chinese economy- burgeons. Our client are positioned in the mid-higher end of the retail spectrum and they are looking at all Home Categories.

IFFC Services

IFFC Services